Enabling

CO2 Reduction

Financial & Operational

Highlights

1,310.3 24%

Revenue $m

315.2 47%

Gross Profit $m

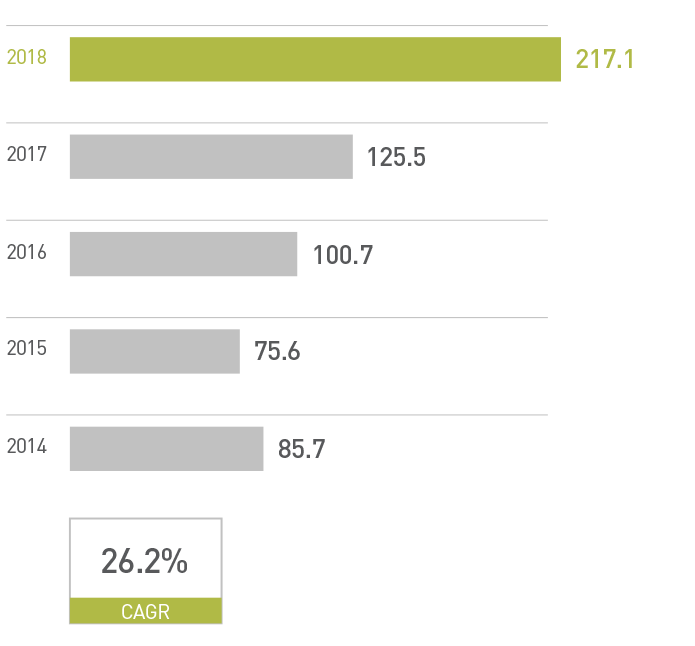

217.1 73%

EBITDA $M

97.4 24%

CASH FROM OPERATING ACTIVITIES $M

38 138%

WORKING CAPITAL DAYS

0.5

NET CASH $M

0.58 (29%)

LOST TIME INCIDENT RATE

1.23 (6%)

TOTAL INCIDENT RATE

2.97 65%

DILUTED EARNINGS PER SHARE $

AMG Critical Materials

1,050.5

REVENUE $M

190.1

EBITDA $M

AMG Engineering

259.8

REVENUE $M

27.0

EBITDA $M

AMG Group

1,310.3

REVENUE $M

217.1

EBITDA $M

Revenue By End Market

21%

Specialty Metals

and Chemicals

9%

Energy

40%

Transportation

30%

Infrastructure

From the CEO

Letter to

Shareholders

On behalf of the Management Board, I hereby present AMG’s 2018 Annual Report. As a summary, we are pleased to declare 2018 the most successful year in AMG’s history, measured in a variety of ways.

Annual Ebitda Progression

(USD millions)

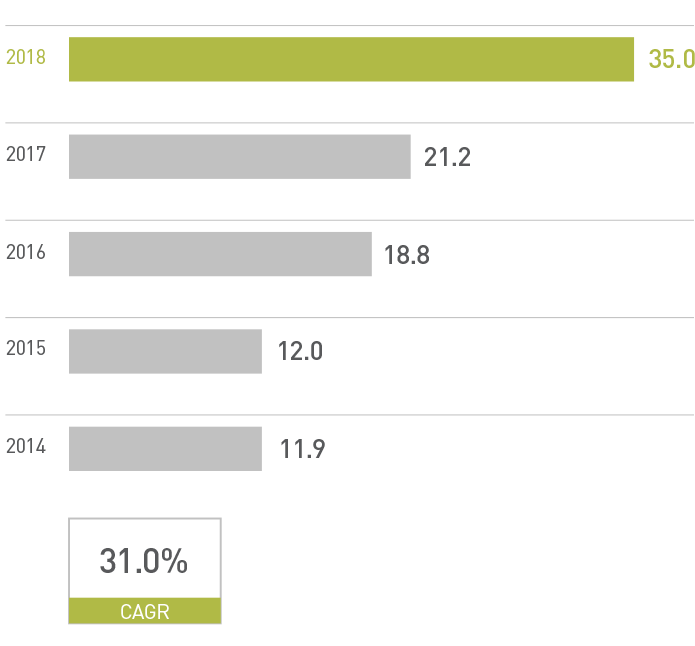

Annual Roce Progression

(%)

AMG

Critical

Materials

AMG CRITICAL MATERIALS REVENUE INCREASED 29% IN 2018 AND GENERATED A 90% INCREASE IN EBITDA TO $190.1 MILLION.

AMG Critical Materials’ revenue increased by 29% in 2018, to $1.0 billion, thanks to a combination of improved pricing and higher sales volumes. Within the division, revenue increased in seven of AMG’s eight critical materials business units.

AMG

Engineering

AMG’S ENGINEERING DIVISION INCREASED GROSS PROFIT BY 14% , FROM $64.8 MILLION IN 2017 TO $73.7 MILLION IN 2018, AND DELIVERED A 17% IMPROVEMENT IN YEAR-END ORDER BACKLOG.

Strong demand from the US market-primarily driven by the high order backlog for passenger aircraft and the need for efficient, environmentally friendly aircraft engines-was matched by strong demand from the Asian market and led to the highest order intake since 2008.

In compliance with the EU’s General Data Protection Regulation (GDPR) regulation, by providing the information above, you grant AMG the right to store your customer data and receive emails about AMG’s press releases. If at any time you wish to have your data removed, please email unsubscribe@amg-nv.com.