DECARBONIZATION

Financial & Operational

Highlights

937.1

Revenue $m

112.7

Gross Profit $m

66.8

EBITDA $M

19.6

CASH FROM OPERATING ACTIVITIES $M

9

WORKING CAPITAL DAYS

287.9

NET DEBT $M

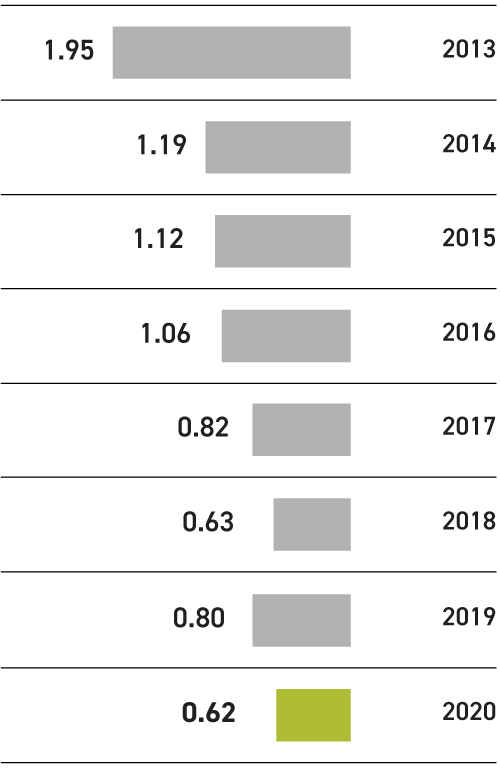

0.62

LOST TIME INCIDENT RATE

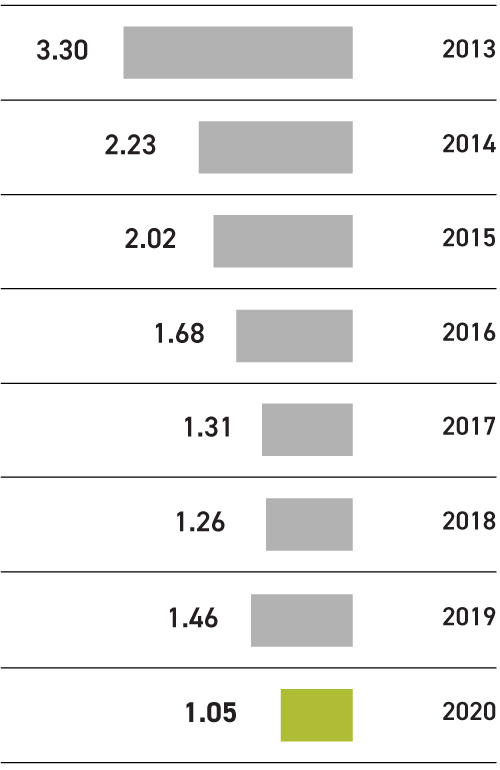

1.05

TOTAL INCIDENT RATE

(1.47)

Diluted Loss Per Share $

AMG Technologies

361.4

REVENUE $M

25.8

EBITDA $M

AMG Critical Materials

575.7

REVENUE $M

41.0

EBITDA $M

AMG Group

937.1

REVENUE $M

66.8

EBITDA $M

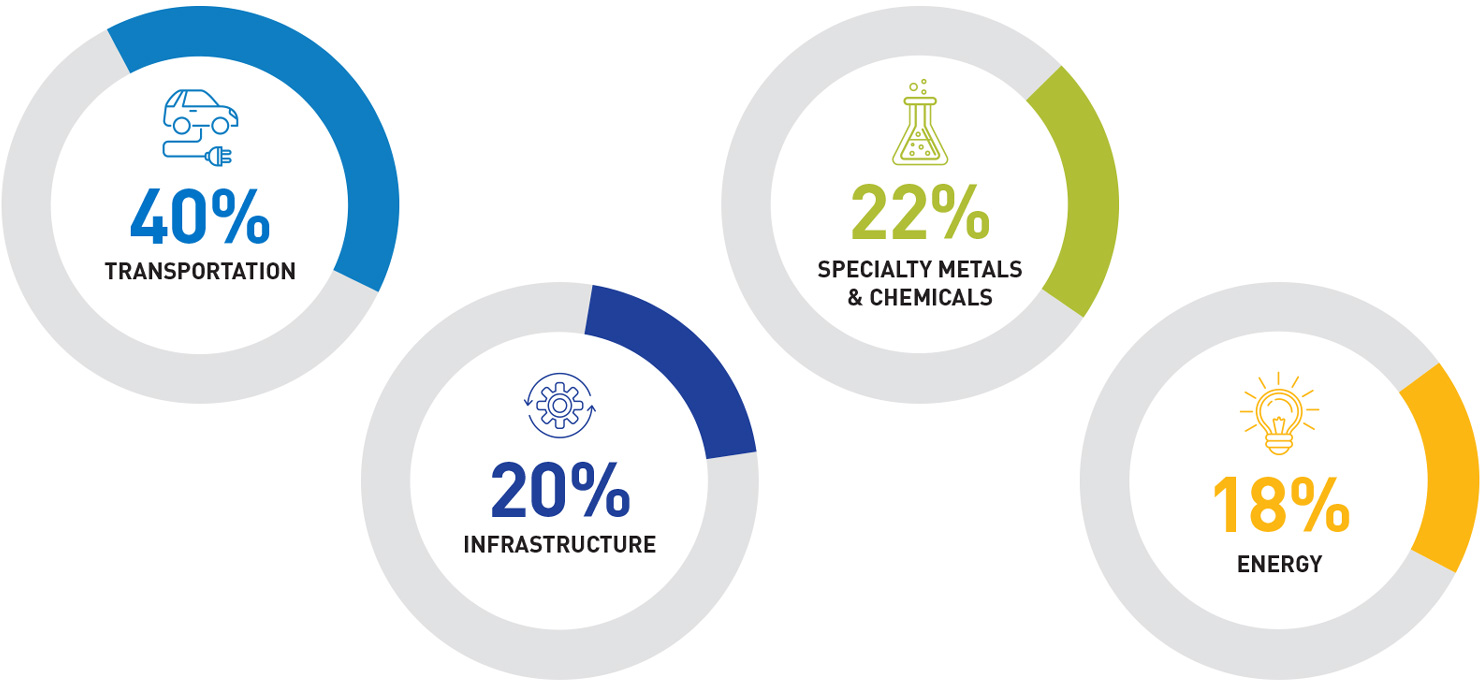

Revenue By End Market

From the CEO

Letter to

Letter to

Shareholders

As is the case for every industrial company, 2020 will be remembered as the year of the COVID-19 pandemic. Early in the year, we developed a plan to keep our employees healthy, preserve liquidity, and cut costs in the face of severely depressed commodity markets relevant to AMG.

LOST TIME INCIDENT RATE

TOTAL INCIDENT RATE

AMG

Critical

Materials

AMG’s doubling of its recycling capacity for refinery residues is proceeding as planned in Zanesville, Ohio, utilizing the funds raised from our municipal bond.

AMG Critical Materials’ gross profit before non-recurring items1 in 2020 decreased by $42.4 million to $68.0 million, driven largely by decreased revenue, which was $575.5 million for the year.

1 Non-recurring items include exceptional non-cash inventory cost adjustments. In 2020 these were $6.2 million, primarily associated with our Brazilian operations, and in 2019 these were $87.8 million, primarily associated with our vanadium operations.

AMG

Technologies

AMG Engineering’s order intake in 2020 exceeded $200 million for the year due to significant orders in market segments outside aerospace, including strong orders from specialty steel producers.

AMG Technologies’ revenue during 2020 decreased by 15% due to reduced aerospace activity and volumes due to the pandemic, as well as lower profitability associated with metal price declines for the Titanium Alloys business. Consequently, gross profit for the year decreased by $42.6 million to $56.3 million.

DOWNLOAD 2020 ANNUAL REPORT

Stay Updated

In compliance with the EU’s General Data Protection Regulation (GDPR) regulation, by providing the information above, you grant AMG the right to store your customer data and receive emails about AMG’s press releases. If at any time you wish to have your data removed, please email unsubscribe@amg-nv.com.